Earn cash back with Dayforce Wallet Rewards

Earn cash back¶ when you shop, dine, or travel using your Dayforce Prepaid Mastercard®. No coupons to clip, no receipts to scan. Just cash that adds up on qualifying purchases at participating merchants. It’s easy! Open the Dayforce Wallet app to see all the latest offers.

Download the Dayforce Wallet app now1

Earn cash back with brands you know and love

Key benefits

It's easy

No coupons to clip, no promo codes or loyalty cards to keep track of, no scanning receipts, no work at all. You don't have to do anything extra. Just get cash back in your wallet when you use your Dayforce Card to make qualifiyng purchases at participanting merchants.

The brands you know and love

There are so many ways and places you can earn cash back—with more added all the time. From national brands to the local businesses you love, it pays to use your Dayforce Card.

It’s all in the Dayforce Wallet app

Open the app to find offers curated just for you, track your cash back, and more. There are over 100,000 places to earn cash back and you can see them all in the Dayforce Wallet app.

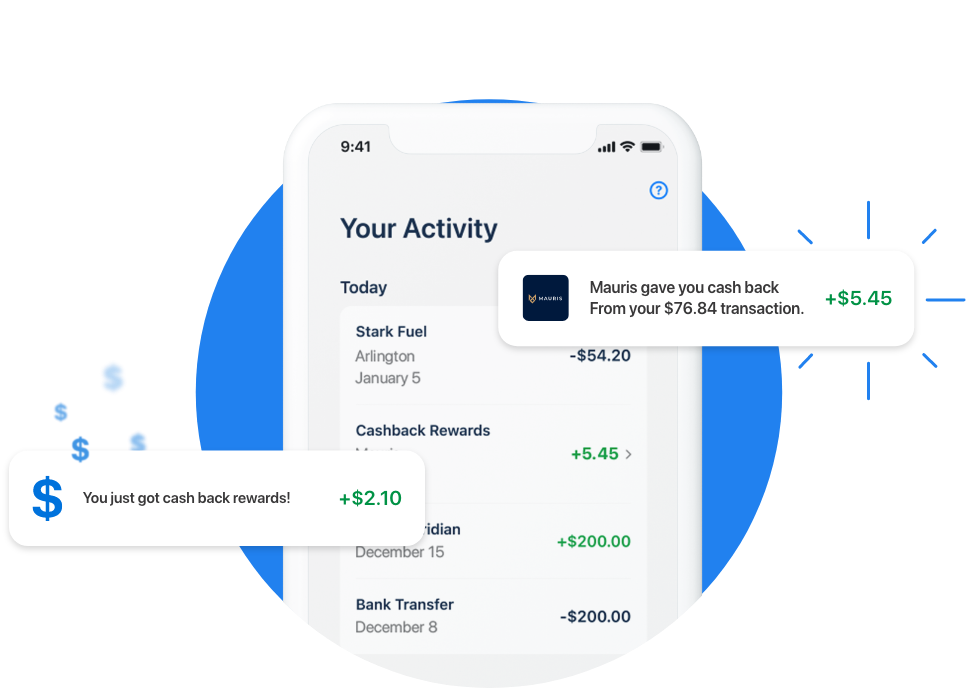

Dayforce Wallet means cash back, automatically!

Shop

Swipe your Dayforce Card and feel the cash back love. We’ll notify you when you earn a cash back reward.

Browse

Open the Dayforce Wallet app, visit the Rewards tab, and check out more cash back offers.

Cash in

We’ll deposit the cash back into your Dayforce Card account. See?

So easy!

Getting paid early just got more rewarding

Download the Dayforce Wallet app now1

Have questions? Learn more about Dayforce Wallet Rewards here

1. Not all employers choose to offer on-demand pay with Dayforce Wallet. Check with your employer to see if this is available to you. Some blackout dates and limitations may apply based on your employer's pay cycle and configurations. Green Dot Bank does not administer and is not responsible for on-demand pay.

2. Early direct deposit availability depends on payor type, timing, payment instructions, and bank fraud prevention measures. As such, early direct deposit availability may vary from pay period to pay period. The name and Social Security number on file with your employer or benefits provider must match your Green Dot Bank account to prevent fraud restrictions on the account.

3. On-demand pay is free; however, fees may apply to certain card and account transactions. Please see Cardholder Agreement or Deposit Account Agreement for complete list of fees.

4. Fee-free ATM access applies to in-network ATMs only. For out-of-network ATMs and bank tellers, a $2.99 fee will apply, plus any additional fee that the ATM owner or bank may charge. Limits apply. Please see Cardholder Agreement or Deposit Account Agreement for details.

5. Limits apply. Subject to your bank’s restrictions and fees. All transfers submitted after 10:00pm PST/1:00am EST will be initiated the next business day.

6. Instant Transfers can only be sent to another eligible bank account in your name with a linked Visa-, Mastercard-, or Discover-branded debit card. An Instant Transfer fee of $3.49 per transfer will be charged. Limits apply.

Apple, the Apple logo, and iPhone are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc.

Google, Android, and Google Play are trademarks of Google Inc., registered in the U.S. and other countries.

Banking services provided by and the Dayforce Wallet Mastercard issued by Green Dot Bank, Member FDIC, pursuant to a license from Mastercard. Mastercard and the circles design are registered trademarks of Mastercard International Incorporated.

Green Dot Bank also operates under the following registered trade names: GO2bank, GoBank and Bonneville Bank. All of these registered trade names are used by, and refer to, a single FDIC-insured bank, Green Dot Bank. Deposits under any of these trade names are deposits with Green Dot Bank and are aggregated for deposit insurance coverage up to the allowable limits.

©2026 Green Dot Corporation. All rights reserved. Green Dot Corporation NMLS #914924; Green Dot Bank NMLS #908739.

Dayforce Wallet is registered with the DFPI as Dayforce Licensing LLC under the CCFPL with a registration number of 04-CCFPL-1938639-3480784.

IMPORTANT INFORMATION ABOUT PROCEDURES FOR OPENING A NEW CARD ACCOUNT: To help the government fight the funding of terrorism and money laundering activities, federal law requires all financial institutions to obtain, verify, and record information that identifies each person who opens a Card Account. What this means for you: When you open a Card Account, we will ask for your name, address, date of birth, and other information that will allow us to identify you. We may also ask to see a copy of your driver’s license or other identifying documents. If we are unable to verify your identity, we will not open an account for you.