ON-DEMAND PAY

Get paid at the pace of real life

HOW IT WORKS

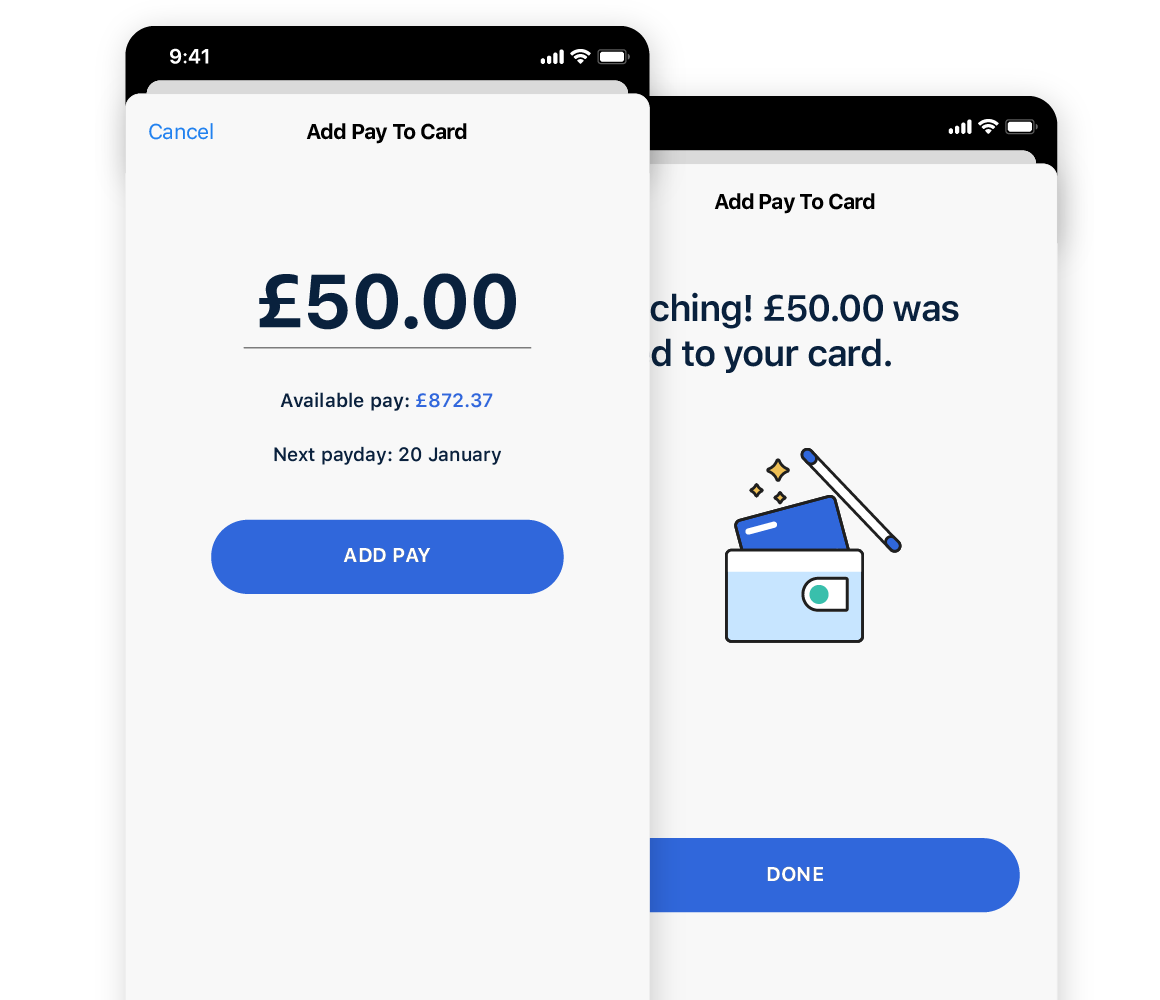

Access the money you earn instantly

Understanding Available Earned Pay

Available earned pay grows when you complete shifts or workdays

Available earned pay shrinks when your taxes and deductions are processed

Some employers have caps or frequency limits on using available earned pay—reach out to your payroll department with questions

Ready to make any day payday?

1. Some blackout dates and limitations may apply based on your employer's pay cycle and configurations.

2. For a complete list of fees that apply, users of the Employer-Sponsored Programme should refer to the Dayforce Wallet Prepaid Mastercard® Terms and Conditions. Users of the Pay as You Use Programme should refer to the Dayforce Wallet Prepaid Mastercard® Pay as You Use Terms and Conditions.

3. No fee to withdraw from cashpoints attached to high street banks. Other ATM withdrawals subject to operator or network fees. For a complete list of fees and limits that apply, users of the Employer-Sponsored Programme should refer to the Dayforce Wallet Prepaid Mastercard® Terms and Conditions. Users of the Pay as You Use Programme should refer to the Dayforce Wallet Prepaid Mastercard® Pay as You Use Terms and Conditions.

Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc., registered in the U.S. and other countries.

Google Play and the Google Play logo are trademarks of Google LLC.

The Dayforce Wallet Prepaid Mastercard is issued by Prepaid Financial Services Limited pursuant to a license by Mastercard. Prepaid Financial Services Limited is authorised and regulated by the Financial Conduct Authority under the Electronic Money Regulations 2011, Firm Reference Number 900036, for the issuance of electronic money and provision of payment services; Registered Office; Prepaid Financial Services Ltd, 4th Floor, 35 Great St Helen’s, London, EC3A 6AP. Company Registration number: 06337638.